how to get uber eats tax summary

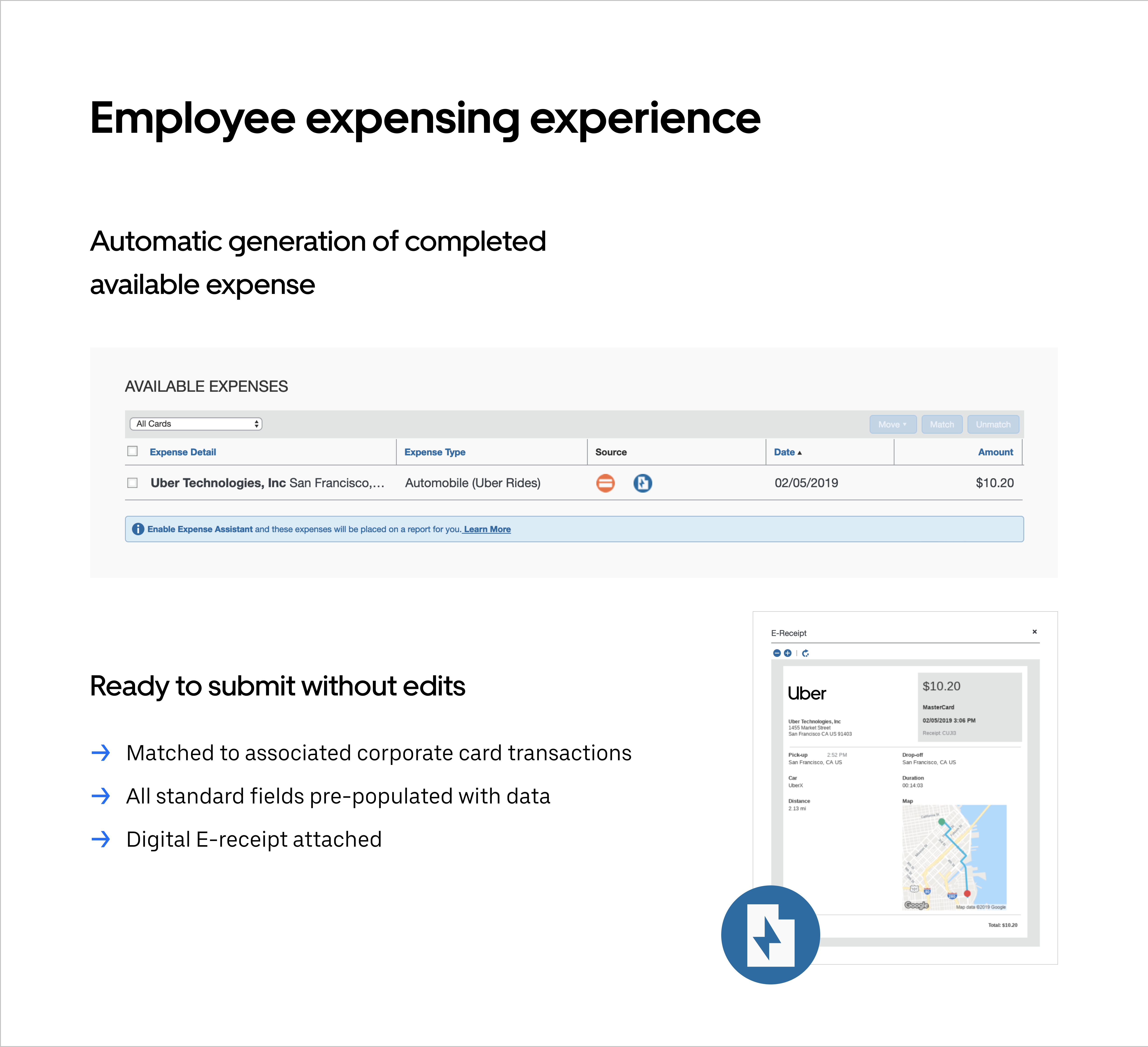

Dedicate a front counter register to processing Uber Eats orders. Use the Uber Tax Summary to enter your income.

What Is Additional Payments From Uber Uber Drivers Forum

They advertised the hell out of their 107 return and it worked.

. Visit the Tax Documents area. Uber Eats and the Annual Tax Summary In my opinion the annual summary is the most important of the three documents you can download from the Tax Information tab. Please submit your issue again through the Uber.

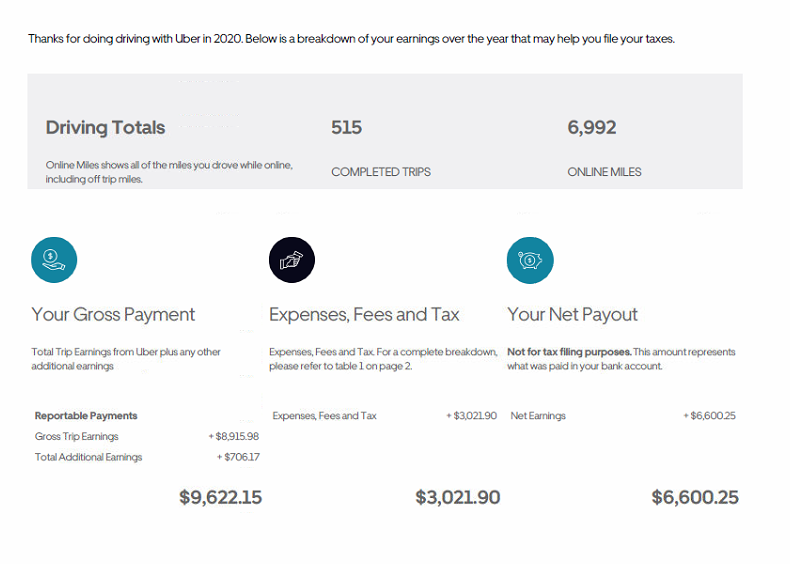

If you log into your Uber driver account you can go to Tax Documents and then find your tax summary. Keep a Logbook Of Your UberEats Driving. Uber eats only got tax summary Yes add the amounts together and report the grand total as income for your self-employed business.

You also have to pay self employment tax. How are sales taxes applied collected and remitted. Information for delivery partners in Australia.

As an Uber Eats courier you are self-employed also known as a. For income taxes its only when youve made more than about 53000 as a single person or 106000 as a married couple that your income tax rate goes. In Turbo Tax Self-Employed online Click on the Federal section in the left.

In March 2021 the Fund had 13400 members. When do I receive my 1099. Select the Tax Information tab from the drop-down menu at the top of the page.

If your accounts for Uber Eats and Uber use a different email address your earnings from deliveries and rides will. Use The Uber Eats App For Dinner Tonight. You arent only paying income taxes here.

Heres the thing. If you have any other questions or issues please visit the Uber Help Center. Hi where can I input Uber Eats Tax Summary items such as On TripMileage when use BIKE no motor vehicle was used Gross Uber Eats fare Tips Incentives and.

Check throughout the day that your store is signed in to Restaurant Manager. Focus on the the tax impact of your Uber Eats earnings. How do I find my uber eats tax summary.

Its simply a form that. Useful tax information is available on your Tax Summaries which you can access through your partner dashboardWe want to help. Where to find your tax information.

Ad 15 Off Your First Order Of 20 Or More. Visit the Tax Documents area. You can enter your income and expenses from your records into the self-employment area.

Be sure to also include any other sources of income. In September 2021 the fund had 16700 members. Expect to pay at least a 25 tax rate.

You can find tax information on your Uber profile We will notify you as soon as your annual Tax Summary is available. It also includes your income tax rate depending on. If you use your car for deliveries you MUST have a valid ATO logbook if you want to.

This includes 153 in self-employment taxes for Social Security and Medicare. Click on Tax Summary Select the relevant statement. How Do I Manage My Taxes for UberEats.

Your link has expired as it has exceeded the 24-hour time window. Its not an extra tax. Thats around 3300 new.

Ordering Food For Delivery Has Never Been Easier. Select the Tax Information tab from the drop-down menu at the top of the page. You will receive one tax summary for all activity with Uber Eats and Uber.

The quickest and most convenient method to obtain a 1099 is to download it immediately from your Driver Dashboard provided you meet the eligibility requirements. The Uber tax summary isnt an official tax document. It doesnt matter that you didnt get a 1099-K form.

Accepting Orders should be visible in the. If you qualify to receive a 1099 the. Except I shouldnt call it a tax summary because its not an official tax.

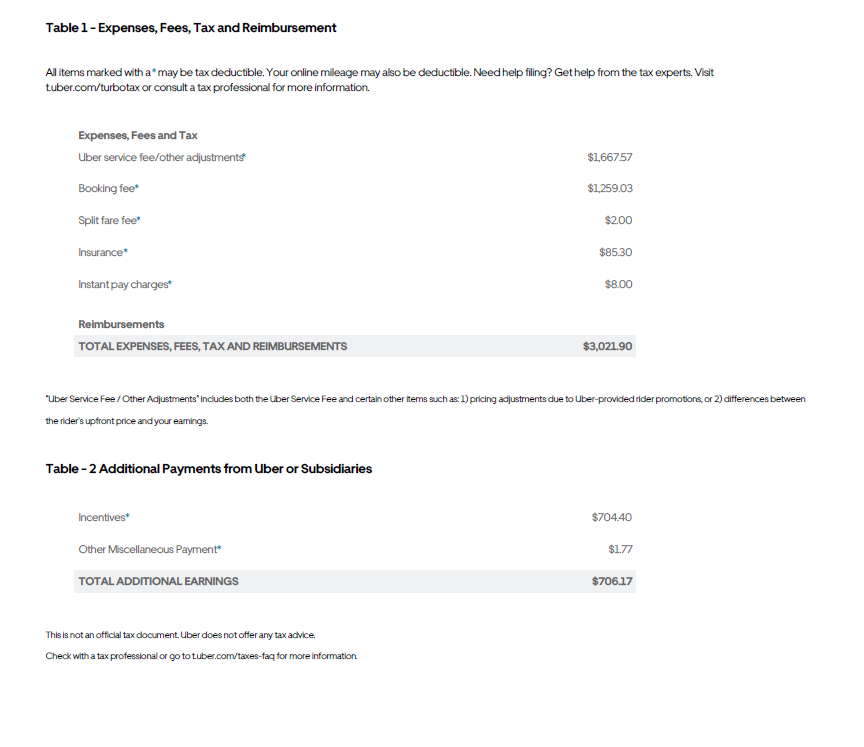

This annual summary reveals your gross Uber earnings as well as the bare minimum of business costs that you can claim like commissions and fees. Requesting currentprevious year tax form s How do I update or change my W-9. Terms And Fees Apply.

Income tax is such a wildcard because of things like other income filing status deductions tax credits and the like.

20 Doordash Things To Know For Delivery Beginners Uber Eats Gruhub Grubhub Delivery Grubhub Doordash

Uber Taxes Explained How To File Taxes For Uber Lyft Drivers Updated For 2020 Youtube

As Ride Hailing Booms In D C It S Not Just Eating Into The Taxi Market It S Increasing Vehicle Trips Rideshare Uber Driver Uber

Is Uber Eats A 1099 Job Everything You Need To Know

How To Read Uber Tax Summary 2020 Explained Instaccountant

Self Employment Robergtaxsolutions Com

Uber Coupon Code First Ride Free Code R2vucayhue Uber Ride Uber Hacks Burn Free

See This Post By Startup Ca On Google Https Posts Gle Ddif2 Www Startupca Org Decisions Announced Today At Fm Press Start Up Income Tax Return Income Tax

If You Re A Serious Driver You Can T Go Wrong With Our Piloch Air Vent Phone Holder Uber Promo Code Uber App Coding

How To Read Uber Tax Summary 2020 Explained Instaccountant

Self Employment Robergtaxsolutions Com

Uber Taxes Explained How To File Taxes For Uber Lyft Drivers Updated For 2020 Youtube

Peterostapowicz I Will Optimize Your Restaurant Menu For Uber Eats Doordash Grubhub And More For 50 On Fiverr Com Menu Restaurant Grubhub Doordash

What Is Additional Payments From Uber Uber Drivers Forum

How Uber Drivers Pay Less Hst In 2022 Uber Driver Tax Services Uber